Die Richtlinie über die Nachhaltigkeitsberichterstattung von Unternehmen (CSRD) ersetzt die Richtlinie über die nichtfinanzielle Berichterstattung (NFRD) und führt strengere Anforderungen für große und börsennotierte Unternehmen ein. Nach der CSRD müssen die Unternehmen offenlegen, wie sie mit sozialen und ökologischen Herausforderungen umgehen. Ziel ist es, die Qualität und Verfügbarkeit von Nachhaltigkeitsinformationen sowohl für Investoren als auch für die Gesellschaft zu verbessern.

Hauptziele des CSRD

1. Standardisierte ESG-Berichterstattung

Die CSRD vereinheitlicht und stärkt die Regeln für die Umwelt-, Sozial- und Governance-Berichterstattung (ESG).

2. Bessere Daten für Stakeholder

Die Richtlinie verbessert die Vergleichbarkeit, Zuverlässigkeit und Relevanz von Nachhaltigkeitsdaten und hilft Investoren und Stakeholdern, bessere Entscheidungen zu treffen.

3. Positive Veränderungen vorantreiben

CSRD treibt Unternehmen zu nachhaltigen, kohlenstoffarmen und umweltfreundlichen Geschäftspraktiken an.

Was war die Richtlinie über die nichtfinanzielle Berichterstattung (Non-Financial Reporting Directive, NFRD)?

Die NFRD wurde 2014 von der Europäischen Union angenommen und trat 2018 in Kraft. Er verpflichtet große Unternehmen, in ihren Jahresberichten Informationen zu Umwelt-, Sozial- und Governance-Themen (ESG) offenzulegen.

Wie unterscheidet sich der CSRD vom NFRD?

- Mit dem Prinzip der doppelten Wesentlichkeit führt die CSRD das Konzept der doppelten Wesentlichkeit ein. Das bedeutet, dass Unternehmen sowohl ihre Auswirkungen auf die Gesellschaft und die Umwelt (Wesentlichkeit der Auswirkungen) als auch die Auswirkungen von ESG-Faktoren auf ihr Geschäft (finanzielle Wesentlichkeit) bewerten müssen.

- Durch den erweiterten Umfang der Berichterstattung verlangt die CSRD von den Unternehmen die Offenlegung zukunftsorientierter Informationen und nicht nur vergangener Leistungen. Außerdem müssen die Unternehmen über Nachhaltigkeitsthemen in ihrer gesamten Wertschöpfungskette berichten.

- Uniform Reporting Standards müssen die Unternehmen nun die European Sustainability Reporting Standards (ESRS) einhalten, die mehr als 80 Offenlegungspflichten und etwa 1.100 Datenpunkte enthalten.

- Nach der CSRD (External Assurance and Integrated Reporting) sind Unternehmen verpflichtet, Nachhaltigkeitsberichte als Teil ihrer Lageberichte zu erstellen, die von Dritten geprüft werden. Dies beginnt mit einer begrenzten Sicherheit und geht im Laufe der Zeit zu einer angemessenen Sicherheit über.

- EU-Taxonomie-Anpassung: Die CSRD erweitert die Offenlegungsanforderungen der EU-Taxonomie auf alle Unternehmen, die der CSRD unterliegen. Unternehmen müssen offenlegen, wie ihre Einnahmen, Investitionsausgaben und Betriebsausgaben mit den sechs Umweltzielen der EU übereinstimmen.

- Digitale Kennzeichnung von Nachhaltigkeitsdaten: Nachhaltigkeitsberichte müssen in digitalen Formaten erstellt werden, um die Daten besser zugänglich, vergleichbar und maschinenlesbar zu machen, wobei die digitale Kennzeichnung gemäß den ESRS-Standards erfolgen muss.

Zeitplan für die Berichterstattung

Die CSRD-Meldepflichten werden schrittweise von 2024 bis 2028 eingeführt, je nach Unternehmensgröße und -struktur. In der nachstehenden Tabelle finden Sie die Fristen je nach Größe Ihres Unternehmens

Worüber müssen die Unternehmen Bericht erstatten?

Die Berichte basieren auf doppelten Wesentlichkeitsbewertungen, die von Unternehmen zu Unternehmen unterschiedlich sind. Organisationen in derselben Branche berichten jedoch in der Regel über ähnliche Metriken.

Was ist eine doppelte Wesentlichkeitsbewertung?

Eine doppelte Wesentlichkeitsbewertung ist für die CSRD-Berichterstattung unerlässlich, da sie bestimmt, was ein Unternehmen offenlegen muss. Sie umfasst:

- ImpactMateriality: Wie sich das Handeln eines Unternehmens auf externe Interessengruppen und die Umwelt auswirkt.

- Finanzielle Wesentlichkeit: Wie ESG-Faktoren die finanzielle Leistung des Unternehmens beeinflussen, Ermittlung von Risiken und Chancen.

Europäische Standards für die Nachhaltigkeitsberichterstattung (ESRS)

Der ESRS legt die spezifischen Nachhaltigkeitsinformationen fest, die Unternehmen im Rahmen der CSRD berichten müssen. Diese Standards sind unterteilt in:

- Querschnittsnormen (verbindlich für alle Unternehmen)

- Aktuelle Standards zu Umwelt-, Sozial- und Governance-Fragen (ESG).

ESRS-Standards im Überblick

Wie kann Qarma helfen?

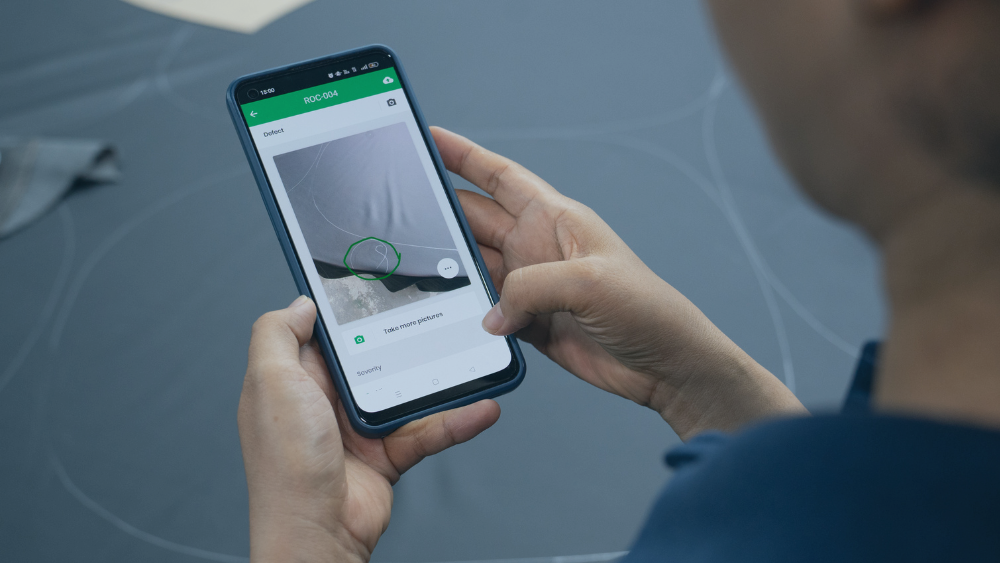

Qarma ist ein großartiges Werkzeug für mehrere Schritte Ihres Berichtsprozesses. Qarma ist ein Sammelwerkzeug, mit dem Sie wertvolle Daten sammeln können, die Sie sowohl für Ihre doppelte Wesentlichkeit als auch für die Berichterstattung verwenden können.

Mit der Funktion Audits können Sie ganz einfach Umfragen und Bewertungen an Ihre Lieferkette verteilen und alle an einem Ort sammeln. Nutzen Sie diese Funktion, um Einblicke und Meinungen zu erhalten, um Ihre Schwachstellen oder blinden Flecken in Ihren doppelten Wesentlichkeitsbewertungen zu erkennen, oder um die numerischen Daten zu den Akteuren der Lieferkette auf dem neuesten Stand zu halten.

Der Nachweis der Sorgfaltspflicht ist auch ein Teil der ESG-Berichterstattung. Sie können dies strukturell und mit validierten Daten tun, wenn Sie Qarma Audits nutzen, um Ihre Lieferkette zu untersuchen. Mit einem einzigen System können Sie Ihre Lieferanten erfassen, Nichtkonformitäten aufdecken und Pläne für Korrekturmaßnahmen erstellen.

Schließlich endet nichts auf Qarma. Wir werden immer dafür sorgen, dass Ihre Daten dort landen, wo Sie sie brauchen, damit Sie sie für die gemeinsame Nutzung und die Berichterstattung verwenden können.

Wenn Sie mehr darüber erfahren möchten, wie Qarma Ihnen bei Ihrer Berichterstattung helfen kann, zögern Sie bitte nicht, uns zu kontaktieren.

.png)